Practical Ways to Simplify & Improve Your Life

Are you feeling like you are just getting by and not living your life on purpose? We can help you simplify your life to let what matters the most take center stage.

Mind & Happiness

10 Helpful Tips to Let Go of Your Past (By a Psychotherapist)

Morning Routine Checklist to Kickstart a GREAT Day!

110 Simple Life Quotes to Inspire You to a Simple & Happy Life

Top 40 Things To Be Grateful For In 2021

75+ Best Hobbies for Women in 2021

11 Tips for Living a More Active Lifestyle

Saving Money

Spend your money on purpose. Take control of your finances by creating your personal budget and learning new ways to cut expenses and save more money.

How to Live on $2500 Per Month in 2024

How to Make Birthdays Special When You’re Broke (50 Cheap Birthday Ideas)

How to Get Married for $1000

13 Ways To Not Spend Money

Saving Money on Groceries

Eating Healthy on a Budget: Top 10 Tips To Save The Most Money

Budget Grocery List: $50 a Week for Two Adults

Organizing Your Home & Decluttering

Declutter your home with intention. Clutter is not just the stuff that is in your closets and on the floor. It’s what stands between you and a happy, simple life.

How Many Shirts Should I Own?

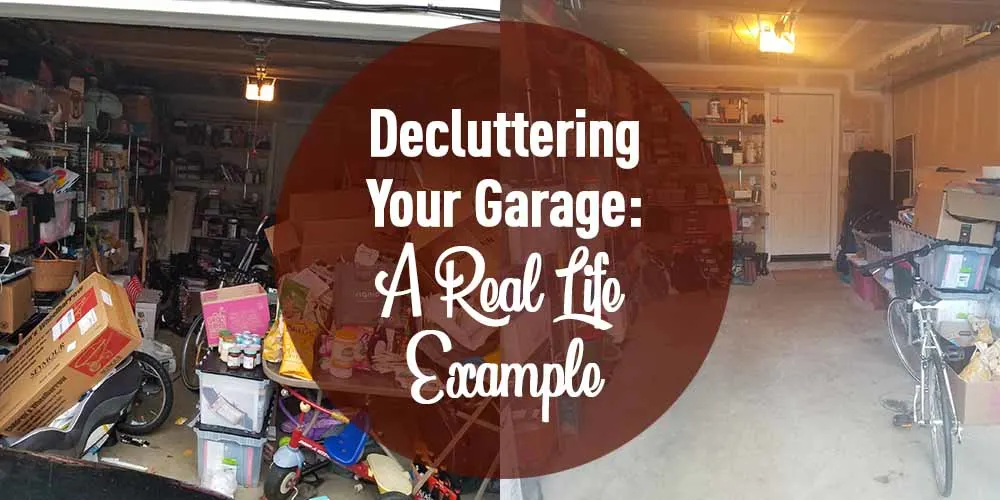

5 Tips to Declutter Your Garage Quickly (Real-Life Example)

Declutter Your Clothes (For a Wardobe that Makes You Feel & Look Good)

Wash Your Bed Sheets Every 1 to 3 Weeks (Take the Quiz!)

How Many Clothes Should I Have?

Declutter Your Home: Where to Start When You’re Drowning in Clutter

Check out our minimalist series of “How many should I have?”:

Setting Goals For a Successful Life

Life is not just about the short-term pressure of saving money, paying the bills, and keeping your home simple and organized. It’s also about living a live on purpose. Thinking about and defining the right short-term, mid-term and long-term goals will set you on a path to success.

New Month, New Goals: 5 Easy Ideas for a Fantastic Month

101+ Long-Term Goals For a Successful Career & Life

60+ Mid-Term Goals to Give Your Life a New Direction

51 Great Goals to Set to Change Your Life

Misc

Seattle’s Top 50 Date Ideas (By 2 Locals)

Left Hand Itching Means Something Is Coming Your Way: Interesting Facts About this Superstition

A few jokes to add humor to your day

110 Best Dirty Dad Jokes Even Your Father Won’t Tell

45 Best Polish Jokes and Memes [2023 Update]

100 Best Chicken Jokes That Will Make You Laugh

130 Funniest Mexican Jokes & Memes [All-Time Leaderboard]

If you are in the mood for jokes or funny memes, check out our food jokes or duck jokes for children, or our Putin jokes, Helen Keller jokes, Little Johnny jokes, naughty or dirty jokes or funniest mental health memes for adults. We all need to shine a brighter light on our days!