Our completely impossible goal is starting to look possible!

We set a goal to pay off all of our debt by the end of this year: $15,732, which includes our car and the new roof we had to put on our house.

Based on our incomes and what I knew we could throw at the debt, it literally was not possible that we could reach this goal. I knew that.

BUT. You never know what a year will bring and I had hopes that by setting a ridiculous goal we would know what to do with every extra dollar we could come up with. Well, I’m feeling so motivated because it’s starting to look like we might be able to make this happen!

You can read the very start of our debt free journey here.

Debt Free Journey Update #1

The Progress

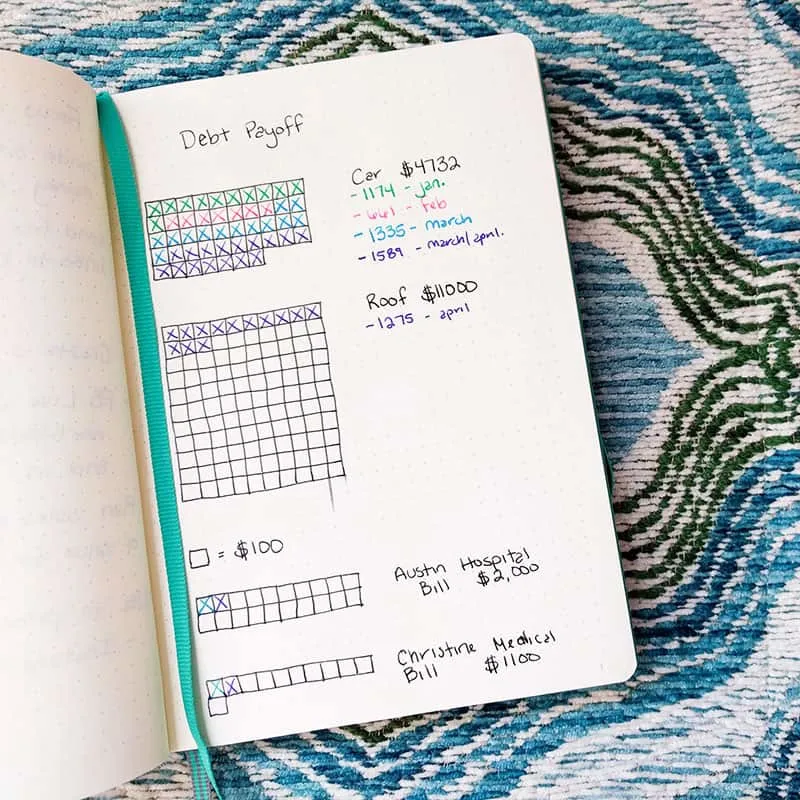

2018 Starting Total: $15,732

Car: $4732

- – $1,174 in January

- – $661 in February

- – $1,335 in March

- – $1,589 in April

- PAID OFF!!!

Roof: $11,000

- – $1,1275 in April

One of the problems we knew would pop up eventually was some medical bills we were waiting on. Unfortunately, we owe around $3,000 in medical bills that are now added to our situation. Womp-womp. We knew it was coming, but it’s still a big fat bummer. Since the hospital doesn’t charge interest and allows payment plans, we are paying about $200 per month on these.

Medical Bills: $3,000

- – $200 in March

- – $200 in April

Current Total Debt: $12,325

Here’s what my bullet journal looks like now:

That current total would look a lot more impressive if we hadn’t had to add an extra $3,000, hahaha! We’ve made awesome progress though.

We’ll have to pay an average of $1,370 on debt every month for the rest of the year to make our goal, which seems absolutely insane. We literally used to live on less than $1500 per month. We’re doing our best though and have made better progress already than I had expected.

How We’ve Paid Off So Much So Quickly

Honestly, I am still in a bit of shock when I look at our progress. I absolutely realize that paying more than $1,000 on debt in a month is a crazy amount of money.

I distinctly remember months when I budgeted every dollar we had and was thrilled when I had $20 left over at the end of the month to add to our savings. So how have we been able to put so much money on our debt?

Blogging

I’ve been blogging for over two years and have just this year starting earning more than what I used to make at my full time job. It has been years of hard work and consistent effort and it’s amazing to see it finally pay off. I feel like I am contributing in a bigger way to our finances which is exciting.

Since my income can fluctuate hugely, we don’t count on it at all for our regular monthly budget. This means that we can use whatever I make (after taxes and expenses) to pay off debt.

Blogging is not a quick way to make money, but I love what I do! If you have an interest in blogging, you should absolutely give it a try.

You can get started blogging with Big Scoots (the hosting company I use and love) for as little as $3.55 per month for shared hosting. Be sure to read about the things I wish I would have known when I started blogging and the only three blogging courses I would take if I could start over.

How cute is this picture that looks like Mozzie is blogging? He was just sitting on my lap making it impossible to get anything done 🙂

The Magic of the 3-Paycheck-Month

Austin gets paid bi-weekly, which means that there are two months each year where he gets three paychecks instead of two. March was one of those months.

I plan our budget around two paychecks, so the third is basically unplanned money when it happens! We used most of his third paycheck to pay off debt.

Ways We’re Saving Money

- Renting ebooks and audiobooks from library: Austin and I listen to a lot of audiobooks and I’ve been trying to read more this year. Instead of paying for books, we use our library card as much as possible. It gives us access to multiple apps where you can rent ebooks and audiobooks without stepping foot in the library and it’s basically impossible to get late fees. (Look at the books I’ve read in 2018 here)

- Homemade pizza nights instead of takeout: We’ve been keeping our eating out budget under control by making homemade pizza on Friday nights instead of getting takeout. I just shared my favorite crust recipe and sauce recipe so you can make your own!

- Double Ad Day: I recently discovered that a local grocery store runs their ads Wednesday-Wednesday and if you shop on Wednesday you can get the sales from last week and this week all at once. A lot of their food is pricey but they run great sales to get you in the store. We got some great deals on fruit as well as chicken for $1.69 per pound.

- Meal Planning: We’ve been eating healthier than ever thanks to the Zero Sugar Diet book, but have stayed within our grocery budget thanks to my meal planning efforts. If you want to learn how to save money with meal planning, I’ve got a great video training series for you! (it’s FREE!) Click HERE to sign up for the free meal planning videos!

- The Dollar Store: I’ve been shopping at Dollar Tree. (…Where everything is actually a dollar. I can’t stand the dollar stores where things cost more. It makes no sense. That’s not a dollar store! Rant over.) We get shower curtain liners, doggy poopy bags, candy for gifts, birthday decorations, and holiday decor for much cheaper than anywhere else.

- Decluttr.com: We got some extra money by selling an old ipod and a video game to Decluttr.com. Their service is easy to use and you get money for the stuff you don’t want anymore. They buy video games, consoles, old phones, tablets, and other tech. Plus CDs, DVDs, textbooks, and LEGO toys.

You Might Like These Posts Too:

How to Have Fun While You’re Paying Off Debt

When to Save and When to Pay Off Debt

How to Live on $2500 Per Month: Our Actual Budget

55 Budget Categories You Don’t Want to Forget

If you’re on a debt free journey along with us, leave a comment and let me know your progress! How are you saving or making extra money? What bumps in the road have you run into?

Chris

Thursday 26th of April 2018

Congratulations! That is awesome to have such a doable goal in sight in less than 9 months! I am pretty frugal and thought I knew all the tricks. LOL. But I recently discovered epsom salts and body wash at the Dollar Tree, which is less than Wal-Mart with my husband's employee discount. I want to try your pizza recipe sometime. Your blog is one of my favorites.

Christine

Thursday 26th of April 2018

Thank you so much Chris! I've never thought of looking for epsom salt at the dollar store. I'll remember that!