Our massive financial goal for the year is to become debt-free (again). We’ve been debt-free in the past and unfortunately we had to take on some debt over the past year or so. I’m very ready to destroy it so that we can have our full incomes back!

Here’s the thing: This is an impossible goal. As our incomes currently stand, it doesn’t look like there’s any way we can make this happen. But that’s not stopping us!

Between a possible tax return, side jobs, and income fluctuations (blogging is like a roller coaster y’all), we just might make more money than we currently expect.

Plus, and this is important, I know that in this circumstance we’ll get farther by aiming big than we would if we set a very easy to achieve goal.

I plan on posting updates every few months on how we’re doing with ‘mission impossible’.

⇒ I would absolutely love for us to accomplish big things together in 2018! If you have a financial goal, leave a comment and we can see how each other are doing when I post an update in a few months!

Join Our Debt Free Journey + See How We’re Saving Money

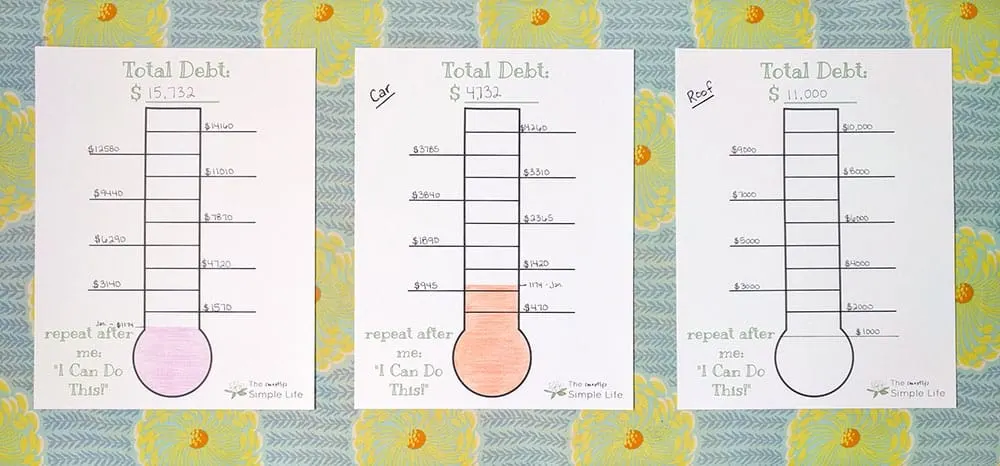

The Debt:

Car: $4732.00

Last winter, our previous car was becoming more expensive to repair than it was worth. We traded it in and got a new-to-us little car and took out a loan of a little over $8,000. This was a major bummer since we were completely debt-free before this. We’ve been throwing extra money at this loan over the past year and have made some decent progress.

Roof: $11,000

We bought a house in 2017 that looked like it might need a roof in the next few years. Unfortunately, we weren’t able to have the roof fully inspected before we closed because of snow on it. (Note to self, never buy a house in the winter.) It turned out that the roof was actively leaking into a bedroom every time it rained. We tried patching things, but by fall it was clear that we needed to just replace the whole thing before another winter. My parents we so kind to loan us the money to make it happen and I’d very-much like to pay them back ASAP.

Grand Total: $15,732

Ok, typing that was the first time I’ve actually totaled it all up. I may have had a mini heart attack… Moving on…

The Plan

We’re planning on focusing all extra money on the car loan first to get that out of the way. That will free up some extra income since we won’t have a car payment to worry about (can’t wait!).

Then we’ll start plugging away at the roof loan. $11,000 is the largest loan we’ve ever had other than a mortgage, so it’s looking a little intimidating to me right now.

Dave Ramsey calls this method snowballing. You put all extra money toward your smallest loan until it’s gone. Then you take all of the money you were using against the smallest loan and put it all towards the next smallest loan. As you go, your snowball of payments gets bigger. I recommend his book, The Total Money Makeover if you want more info or inspiration about paying off debt.

The Problems

I find that I’m more successful at accomplishing a goal when I anticipate problems and decide how I will handle them before they come up. I highly recommend thinking about what problems you might encounter while you’re working toward a goal and deciding ahead of time what you will do if one comes up.

Here’s where I foresee issues:

- Medical Bills: We’ve got a whole lot of medical bills coming our way, including a $2,000 one at some point. The plan is to pay the smaller bills off as they come. If we get a huge one, we’ll use the hospital’s payment plan to break it down. The hospital doesn’t charge interest, so we’ll be better off making payments on bigger bills for a few months and continuing with decent sized debt payments.

- House Projects: I’ve got a list of house projects we need to work on this year. None of them are huge, but will all cost some money. My plan is to save a chunk of our tax return to be used for all house projects for the year. I’ll carefully budget each small project to stretch that money as far as possible.

- Socializing: I’ve noticed that we go a little over our monthly budget each time we hang out with friends. We always bring some snacks or drinks and $15 here and there adds up. I’ve added a new section to our monthly budget to help with this. I’ve added a $30 socializing/entertaining category so that we have money specifically set aside for time with friends.

Progress

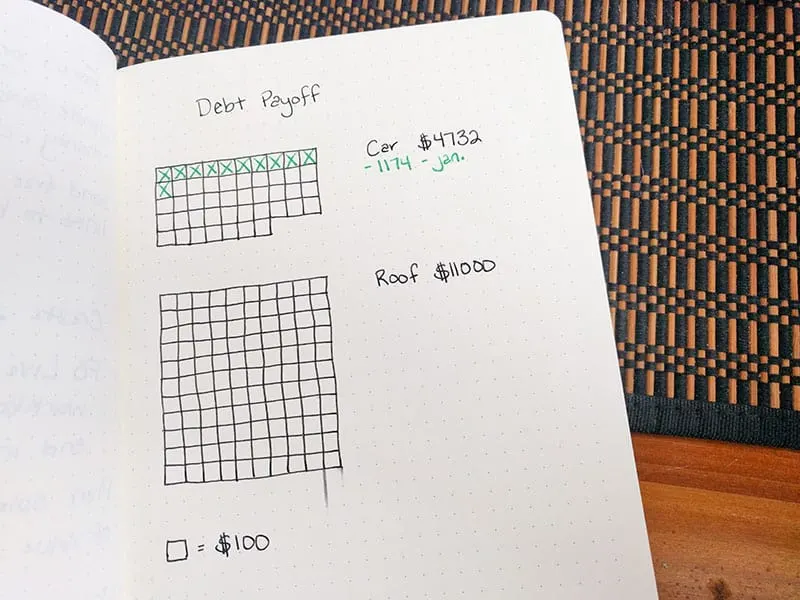

I had a great month in December for my blog! Plus, I got paid early for my ads, which was super nice. I’m making an extra big car payment for January — Our regular payment + $1,000 (!!!).

2018 Starting Total: $15,732.00

Current Total: $14,558.00

We’re tracking our progress on my debt-payoff thermometer. I’ve got one for each debt, plus a total debt one.

If you want to get my free printable debt-payoff thermometer, enter your info below and I’ll email it to you!

I can’t tell you how helpful it is to have a visual way to see your progress. Years ago, when we were saving so that Austin could go back to school without any loans, I had a savings thermometer and it was so motivating. Can’t wait to get these completely colored in!

I also decided to track our progress is the leuchtturm journal my brother got me to see which method I like best.

How We’ve Saved Money Recently

With such a big goal, we’re working hard to stick to our budget and save money wherever possible. You can take a look at our $2500 per month budget here.

Here’s what has been helping most recently:

- Programming the thermostat. I programmed our thermostat to be at 67 degrees during the day throughout the winter (I tried 66, but it felt too cold!). It drops down to 63 after we go to bed. We sleep better in cooler temps, and we’re already asleep by the time it drops so we don’t even notice. The house is warm again by the time we wake up in the morning.

- Meal planning. I’ve done well lately sticking to our $70 per week grocery budget. I’ve got a really great meal planning video series that I think you’ll love! You’ll learn about super simple meal planning, saving money on food, and common meal planning mistakes (plus how you can avoid them!).

Click HERE to sign up for the free meal planning videos! - Having fun at home. It sure helps that it’s winter and we have no desire to go anywhere, but we’ve been staying in and saving money because of it. We’ve played cards, video games, watched movies, and exercised at home.

- Thrift shopping. I’ve bought a few pieces of clothing recently but haven’t spent much at all. We have a great local thrift store that I always find great things at. Plus, I just discovered Swap.com. It’s an online consignment store and they have really nice brands that I would never be able to pay full price for. I had to make a return for one item and they had really amazing service, which sealed the deal for me loving them.

- LED lights. Our electric bill has been much higher than expected the last few months, so we decided to switch some old light bulbs out for LEDs to see if that helps. We got a great deal on LEDs and changed out the bulbs for the lights we have on most often.

- Unplugging the freezer. We have a basement freezer that I used to keep stocked. I haven’t used it much lately and I realized that I could probably fit what was being stored in there in our regular freezer. I did some reorganization and unplugged it to help our electric bill.

- Rewearing dresses. I’ve actually had a lot more occasions to get dressed up in the last few months than I would normally. I resisted the urge to buy new dresses and just kept re-wearing the few I have. I love my eShakti custom-fit dresses and they can look so different depending on how I accessorize them. I wore the same two dresses for multiple occasions!

I’m so excited to get to work on this debt and see if we can be debt-free by the end of the year!

It would be absolutely amazing to get to keep all of our extra income instead of using it to pay off debt. It has always been our dream to own a house on a lake, so we would finally be able to save for that!

You Might Like These Posts Too:

How to Have Fun While You’re Paying Off Debt

When to Save and When to Pay Off Debt

How to Live on $2500 Per Month: Our Actual Budget

What are your financial goals this year? Are you saving up for something special or will you be on a debt free journey along with me?

Please leave a comment and we can check in with each other when I post my next update!

Kimberly Beasley

Wednesday 31st of January 2018

I am one of the "under-employeed" survivors of the mini-recession! I used savings and retirement to keep the house, so, at 55 I am starting all over! Not to mention my daughter started college in August and there is no on-campus housing--can I just praise the Lord we actually made that happen?! :) I barely make enough money to pay day-to-day living expenses, but I have GOT to save some money. I've downloaded a budgeting app now and as of January I track my expenses against my budget. I also wrote down my top money priorities).

Writing down my monetary goals and taping them to my calendar keeps them in front of me. 1) establish and fund savings accounts (emergencies, vacation, gifts, car maint): This will be included in my Feb budget and I'll start putting a small amount back each month--will increase it every monty. 2. establish and fund new retirement plan: I have retirement at my job but won't be vested for another 6 years. Pending more research. 3. establish retirement and savings account for my daughter NOW: have made some progress by getting her to use an app that takes money from every debit card transaction and puts it aside (rounds it up the nearest dollar). Need to do more!! Establish a savings account by Feb 28th. 4. Grow side cleaning business - ongoing research on how to market and get more jobs so I have more income from this work. Also researching other possible side jobs that could possibly support me full time eventually (pet sitting business; drop-shipping, etc.)

Wish us luck!! Thank you!!

Christine

Wednesday 31st of January 2018

I'm so excited for you Kimberly! Making and sticking to your budget will help you SO much! And working on retirement and an extra source of income... fabulous! You can do it :)

Becky

Tuesday 30th of January 2018

We're on the debt-elimination journey with you. We have one more non-house loan to eliminate, then we're on to saving our 6 month emergency fund, then throwing it at the house. My goals for this year are pay off the last loan, save the emergency fund, pay an extra payment to the house, start my husband's IRA, and budget (while learning where our gaps are) for the entire year. We're a month in and doing well so far. We've had 2 surprise items that weren't budgeted for, but we'd fortunately over budgeted in other categories enough for some leeway. I'm hoping by the end of the year, we have a good understanding of all the items we for which need to build sinking funds, since this budgeting thing is new to us.

Christine

Tuesday 30th of January 2018

Sounds like you have an amazing plan Becky!! Sinking funds are super helpful for expenses that don’t come very often. You’re going to have an amazing year working on this!!

Nicole Kohorst

Tuesday 30th of January 2018

We dipped into savings a bit and paid off a student loan recently - felt awesome. Although we have some credit card debt and car loan remaining, we are working on these next. We want to be credit card debt free and would like to pay off car in 2019 (still sooner than expected). Aiming to save few thousand for emergencies, just in case too. My husband is in school and will be done next year. With that comes his student loans that will start payments. Once car is done, we plan to start paying off few months earlier than needed. Anything extra thrown into it. Best of luck fellow money changer!

Christine

Tuesday 30th of January 2018

You can do it Nicole! Sounds like a great plan. That’s awesome that you’re planning ahead to be able to tackle the student loans!