You can’t talk about personal finance without mentioning Dave Ramsey, right? He’s got a whole empire dedicated to helping people get out of debt. The Total Money Makeover is his book that walks you through his entire seven-step process (a.k.a. the baby steps).

I am a fan of Dave Ramsey and his practical approach to handling money. BUT, I don’t follow his advice to the letter. In this review of The Total Money Makeover, I’ll share what’s great about Dave Ramsey’s plan as well as the parts I disagree with.

The Total Money Makeover Review

Click Here to Purchase The Total Money Makeover

The Total Money Makeover (TMM) is all about making over your financial situation. This is all based around Dave Ramsey’s baby steps that will help you get out of debt, stay out of debt, and do great things with your money.

Here’s the rundown of how it works:

The Baby Steps

Baby Step One: Save $1,000 as a Starter Emergency Fund

Crazy expenses can pop up and in order to keep from going into more debt, it’s important to have an emergency fund to handle the unexpected. TMM starts you off with a small $1,000 fund to keep little emergencies at bay.

Baby Step Two: Pay Off Debt with the Debt Snowball

Your money power is in your income! Imagine how your current income would feel without any debt payments. Crazy, right?

In this part of the plan, you list your debts from the smallest balance to the largest and start throwing all the extra money you’ve got at the smallest debt until it’s gone (while still making minimum payments on the rest). Once you pay off the smallest debt, you take the payment you were making on it along with all extra money and start paying off the next smallest debt.

The magic here is in the motivation. Depending on interest rates, it might be more financially smart to pay off your debts in a different order, but by paying them off smallest to largest, you get to have your first victory quickly and you have even more money available to pay on the next debt.

Debt payoff is the real meat of the plan because once you have zero debt (except your mortgage) you have money available to do other things.

You can read about our debt-free journey:

- The Start. Our Goal + How We’re Saving Money

- Update #1. The Impossible Might Happen!

- Update #2. Makin’ That Money Honey

Baby Step Three: Finish the Emergency Fund

With all of your debt paid off, you move on to increasing your emergency fund. $1,000 isn’t a lot, so TMM recommends increasing this amount to three to six months worth of expenses. This really makes you debt-proof. You probably won’t go back into debt if you can handle a job loss or a large home repair with that kind of money.

Baby Step Four: Invest 15% of Your Income in Retirement

Whether through a 401(k), IRA, or other investing, TMM recommends that you invest 15% of your income toward retirement. This is probably possible now that you don’t have any debt payments.

Baby Step Five: Save for College

If you have kids, this is where you start saving for them to go to college. The book goes into plenty of details about planning how much to save, where to put the money, and what to do if college is only a couple of years away for your kids.

Baby Step Six: Pay Off Your Home Mortgage

After paying off all debt except your mortgage, saving an emergency fund, investing in retirement, and saving for college, it’s time to get rid of your last debt payment: the mortgage.

The book dispels many myths about wanting to keep a mortgage and shows you the smart way to purchase a house. Dave Ramsey is ok with mortgage debt for buying a house but he explains a specific way to do it.

Baby Step Seven: Build Wealth

Things are looking good at this point. The book explains how to do three great things with your money: have fun, invest, and give. How exciting!

Here’s What We Don’t Follow:

I actually love this book and the whole method laid out in a simple, practical way. However, we don’t follow it perfectly. We do what works for us!

$1000 Starter ER Fund

The Total Money Makeover recommends a starter emergency fund of $1,000. If you happen to have more than that in savings (not including retirement accounts), it recommends that you use everything except $1,000 to pay towards your debt snowball.

For me, $1,000 isn’t enough of a starter emergency fund. That’s not even one month of expenses. A job loss or large car repair would wipe that out in an instant.

I understand the thinking behind it: If you have no money in savings, $1,000 is great and will keep you from going into more debt. If you are used to having more than that, it might make you a little uncomfortable which will motivate you to get your debt paid off ASAP.

We’ve chosen to keep a much larger emergency fund even while we’re paying off debt. It’s a personal choice and I feel much better knowing that we can handle some bigger emergencies if we have to.

Paying with Cash

Dave Ramsey makes a big deal about cutting up your credit cards and paying for everything in cash. Given how common credit card debt is, I get it.

However, when I have tried to only pay with cash, I end up spending money so quickly and then having no idea where it went. Then I have a problem. It just doesn’t work well for me. Plus, in 2021, cash isn’t exactly the most convenient way to pay for things.

Credit card debt has never been a problem for us. I’ve always paid off our balance in full every month and I’m diligent about sticking to our budget. Plus, I can pull up our statement and see where we spent our money. We have one credit card that we use for everything and we pay it off in full each month. Personal finance is personal and this is what works best for us.

If you have credit card debt or did in the past, I can see where spending with a card may get you into to trouble and “cash only” may be a safe strategy.

Stopping 401(k) Contributions

As part of your debt snowball, TMM recommends stopping all 401(k) contributions until you’re at baby step four. This means you’re losing time for that money to gain interest and missing out on any employer matched that may be offered.

For me, it really depends on how much debt you have and how much extra money you can pay on it each month.

As we’re paying off debt right now, we are still contributing to a 401(k). With those contributions, we still have a large chunk of money left over each month to pay on our debt. I’m happy with the pace of our progress even with the contributions happening.

If contributing meant that there was only $50 left to put on debt each month, I would reconsider because it would be keeping us from making big progress.

Here’s What I Love About This Book:

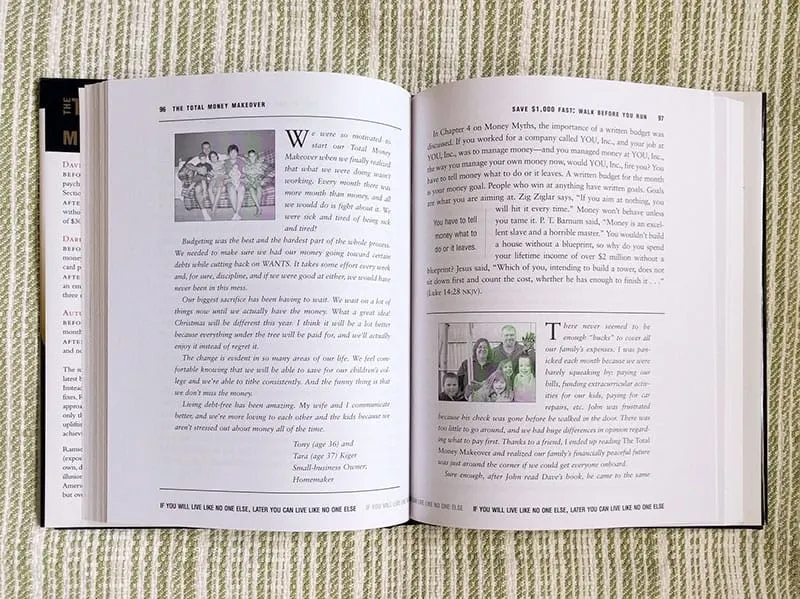

Inspiring Stories!

There are so many letters spread throughout the book that people on the baby steps have written. Their stories are inspiring and motivating!

The letters come from people in all walks of life, with differing amounts of debt, and in various steps of the journey. You really feel like you can accomplish this with so many real life examples.

Actionable Advice

The Total Money Makeover lays out each step for you so that you can take action! It’s not theoretical. It is practical and meant for any person to read and follow.

The steps are simple and go into great explanations including addressing any myths or resistance you may have.

Worksheets

Along with actionable advice, there are plenty of worksheets to help you figure out your own situation. You can write out your debt snowball, estimate college savings, and start your budget with the worksheet included in the book.

Purchase The Total Money Makeover

I think that Dave Ramsey’s The Total Money Makeover gives solid financial advice.

I don’t see anything wrong with following his program to the letter. However, I recognize that personal finance is personal! People are successful when they find what works for them. Obviously, the baby steps work for huge amounts of people, which is awesome!

If parts of it don’t work for you, no worries. I absolutely recommend The Total Money Makeover, but I also suggest that you tweak whatever you need to so that it works for you!

You Might Like These Posts Too:

- How to Live on $2500 Per Month: Our Actual Budget!

- How I Stick to a $70/Week Grocery Budget

- 101 Money Saving Tips

⇒ Have your read The Total Money Makeover? What did you think?

Emily L

Tuesday 20th of July 2021

I love this book. We were out of control with spending and overwhelmed with credit card debt and the simple steps made getting out of debt feel like something we could actually do. We’re super close to being debt free now and can’t wait to start saving up the rest of our emergency fund! They also have a free budgeting app now called EveryDollar to help you budget and track your spending on your phone 📱🥰

Christine

Saturday 24th of July 2021

That's great to hear, Emily. Thanks for sharing your experience, and congratulations for taking the steps to make this happen!

Marc @ Vital Dollar

Thursday 6th of September 2018

I read this book a few years ago and really liked it. What I appreciate the most is that Dave's approach is simple and anyone can grasp it. I can't say that it changed my life, but our only debt was our mortgage and I was mostly interested in reading his opinion on paying off a mortgage vs. saving and investing. I've recommended this book to a few family members after reading it myself.

Christine

Thursday 6th of September 2018

Thank Marc! I definitely agree that one of its best qualities is that it makes budgeting and debt payoff simple and understandable. Anyone can get started!