We became debt free last year, but in truth we had been debt free before! We’ve been in and out of debt a few times over the years, and let me tell you, I much prefer to be out of debt.

There are three elements that have helped us stay out of debt. When we didn’t have all three of these elements in place, we often ended up back in debt. So let’s get into the elements you can put into place that will help you stay out of debt!

Sidenote: If you are currently in debt and want a step by step plan for how to pay it all off, I recommend that you start with reading The Total Money Makeover.

How to Stay Out of Debt

Have An Emergency Fund

If you have a medical emergency, big car problems, a leaking roof, or a job loss, you need to be ready for it! You may not know exactly what the emergency will be, but you know that emergencies do happen. And each of those emergencies I just mentioned can easily put you in debt.

We went into debt a few years ago because the house we had just purchased unexpectedly needed a new roof. We had an emergency fund at the time, but it wasn’t big enough to handle a new roof.

An emergency fund that is big enough to cover three to six months’ worth of expenses is recommended, but honestly, anything helps! Five hundred to one thousand dollars is an excellent start and will keep you from acquiring small debts that can add up and overwhelm you.

If you want to stay out of debt, make sure you’re saving money in an emergency fund!

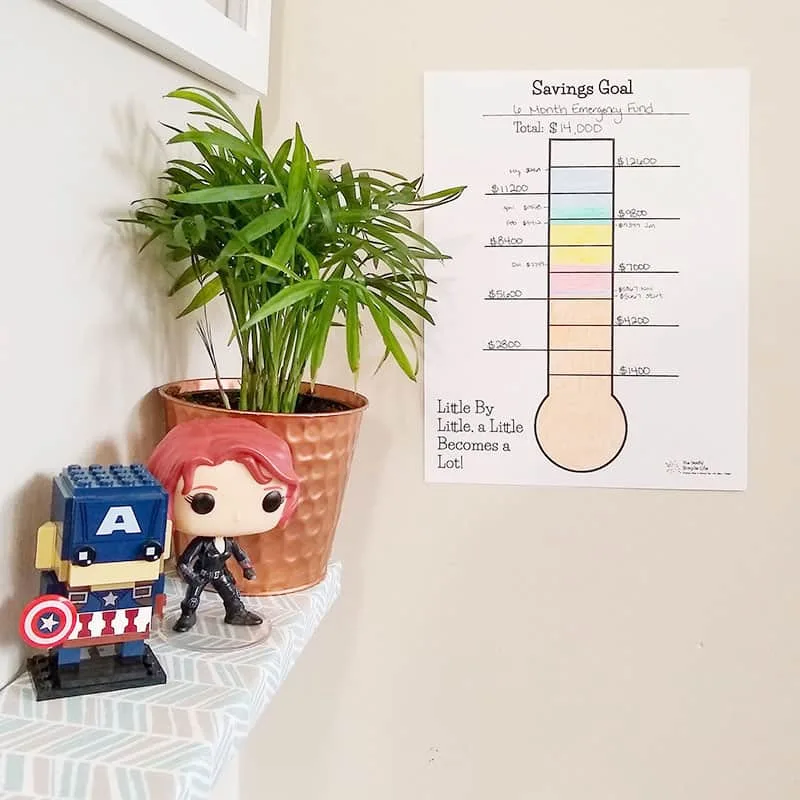

I love having a way to see the financial goals we’re working on. As we were saving up our emergency fund, I tracked our progress on one of my thermometer printables. You can download my free thermometer printables when you enter your info in the form below:

[convertkit form=834534]

Use Sinking Funds

There are plenty of expenses that come up that are not emergencies at all. They can be planned for and saved up for ahead of time. To stay out of debt, we use sinking funds to gradually save up for big expenses that we know are coming.

You can save up for Christmas spending, a new car, car repairs, birthdays, new clothes, annual bills, etc. — all of which can cause debt if you’re not prepared for them.

Another one of our debts was caused by our needing a new (to us) car. If we had been saving money in a sinking fund each month, we wouldn’t have gone into debt for a car. We knew our car wouldn’t last us much longer, but we still were unprepared for the expense.

I’ve got a whole lot more info about sinking funds if you want to learn more: ways to set up your sinking funds, plus all of the sinking fund categories you may want to use.

Get On a Budget

How do you go into debt? You spend more than you earn. So it makes sense that to stay out of debt you need to make sure that you aren’t doing that!

A budget will help you plan how you want to spend your money, and track your spending so that you don’t spend more than you earn and go into debt. It’s as simple as that!

Creating a budget doesn’t have to be super complicated. Make sure to look at the posts below for all kinds of budgeting help that will get you started!

- The Fastest Way to Create Your First Budget

- Your Easy Budget Starter

- 9 Budgeting Myths That Are Holding You Back

- 19 Expenses to Cut From Your Budget When Things Are Tight

![]()

I’ve got a free printable that you can use to start tracking your spending today! Enter your info in the form below to snag it!

[convertkit form=980628]

Having an emergency fund, sinking funds, and a budget in place will help you stay out of debt in the future. I recommend that you use all three of these.

From experience, I know that when we’ve been missing one, we were in danger of going into debt. Right now, we have all three elements in place and I’m confident that we can stay out of debt!

30 Day Money Challenge Ideas - The (mostly) Simple Life

Monday 14th of October 2019

[…] How to Stay Out of Debt […]