We’re totally a bit old fashioned in the way that we track our spending and bill payments.

There is a massive variety of apps and programs available that can help you track your spending and they work really well for tons of people. And if that works for you, I’m all for it!

I know a lot of people love using the Mint, Spending Tracker, and Mvelopes apps.

Personal finance is personal! Which means what works best for you might not be the best thing for me.

I’ve already shared with you a close-up look at our actual budget. Now I’m going to share how we keep track of the money we spend and the bills we need to pay.

*Update: See our current $2500/month budget here

Why We Don’t Use Budgeting and Spending Tracking Apps

I’m Not Comfortable With The Access They Have To Accounts

Most budgeting apps and apps that track your spending need access to your accounts.

They can see all of your charges on various credit and debit cards so that they can tell you where you’ve been spending your money. Some even need access to investment and mortgage accounts.

I’m not at all comfortable with an app having access to any of my accounts, let alone all of them.

I Like To Divide Purchases Into Multiple Categories

To help keep on top of our tight budget, I divide our spending into multiple categories.

I separate groceries from things like shampoo and trash bags.

Apps that track your spending only see that I made a purchase at Walmart. They don’t see that I bought items that should be divided up into different spending categories.

The Simple Way We Track Our Spending On a Tight Budget

My Solution: One Spreadsheet to Rule Them All

You know I like to keep things simple.

I have created a spreadsheet that I use to track all of our spending. It also reminds me of what bills I need to pay. And it’s all on one piece of paper. Easy-peasy.

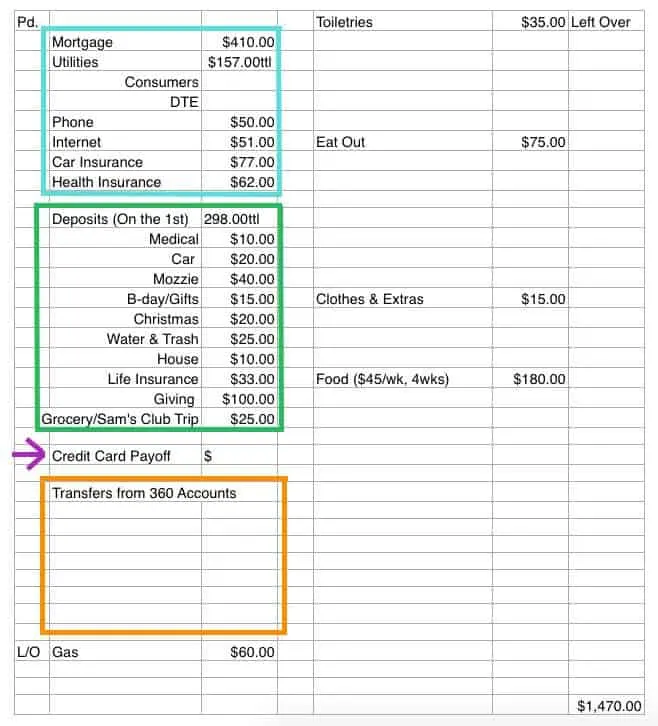

The Blue Box

This is where I list our regular monthly bills: our mortgage, utility, phone, internet, and insurance bills.

In the left-hand “paid” column, I leave a check mark when that bill has been paid, either by me or through an automatic payment.

This works well as a reminder of all of our regular bills that need payment.

The Green Box

The green box shows all of our monthly automatic deposits.

This is how we save for irregular bills and expenses.

On the first of the month, money is taken from our checking account and placed into individual savings funds for categories like Christmas, car fixing, and our quarterly water and trash bill.

I leave this section on our budget as a reminder of where a big chunk of our money is going. I’ll check off the “paid” box on the left when the deposits have gone through.

I highly recommend using Capital One 360 savings accounts.

They allow you to have up to 25 separate savings accounts. You can nickname your accounts to correspond with your chosen categories and have money automatically deposited to the account as regularly as you want.

I plan our budget monthly, so I have money automatically added to our accounts on the first of every month.

I have used Capital One 360 for many years now and these savings accounts have helped our budget immensely. Plus, they give you a .75% interest rate which is way better than our regular bank.

The Purple Arrow

We pay off our credit card in full every month.

I put it on my budget as a reminder that the bill needs to be paid. I’ll write in the amount that I paid off when I make this payment.

The Orange Box

Throughout the month, when we spend money that needs to come from one of our mini savings funds (like buy a birthday present or take Mozzie to the vet), I write down what I need to transfer.

So, I’ll write down that I need to transfer $30 from our car fund to our regular checking account to pay for an oil change.

Or I’ll transfer $75 from our “water and trash” savings account when I get our bill from the city.

Related Posts:

Our Actual Budget: Living on Less Than $1500/Month

13 Secrets to Saving Money on Food (while eating healthy)

The Huge Financial Benefit of Staying Home

Tracking Our Spending

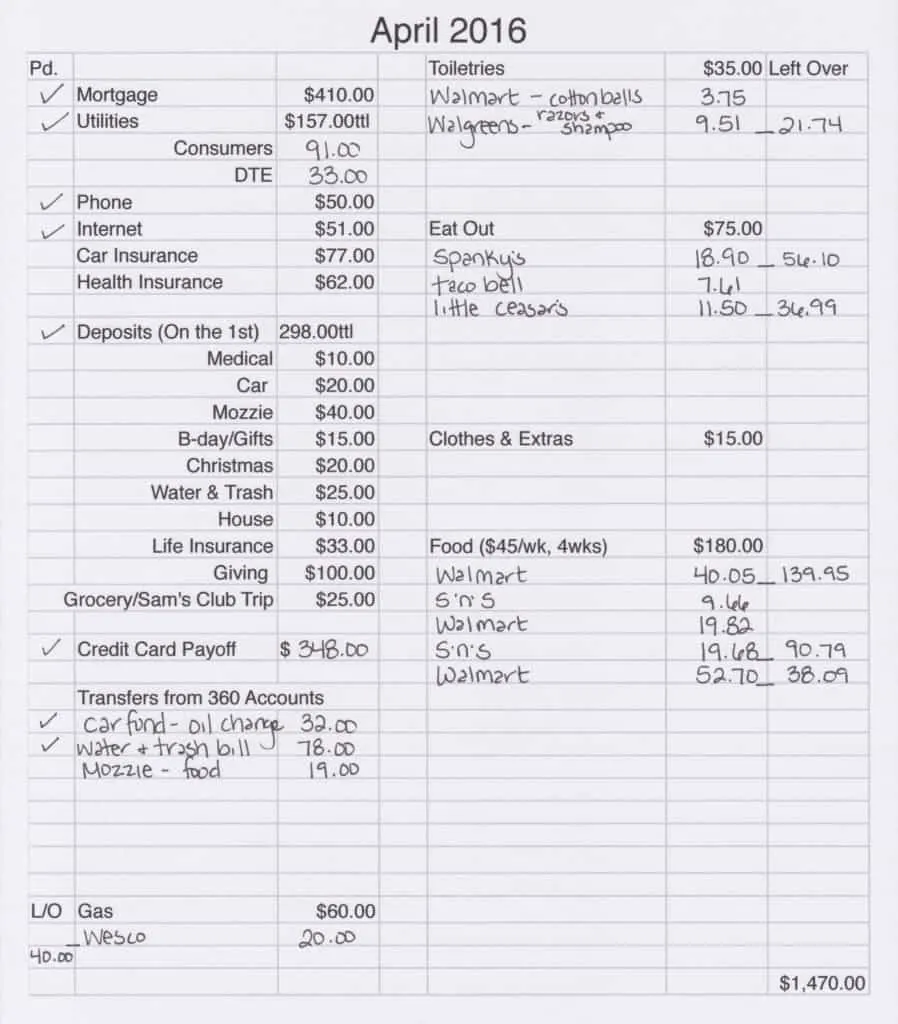

The rest of my spreadsheet shows my budget categories for gas, toiletries, eating out, extras, and groceries.

Whenever we make a purchase, I make sure that we get a receipt. When I get home, I take two minutes to record what we spent under the proper category.

Sometimes I’ll divide up a purchase into multiple categories.

Example: We spent $70 at Walmart. $10 of it was for stuff for Mozzie, so I write down that I need to transfer money out of his savings account and back into checking. $40 was for groceries, so I mark that in the grocery column. $20 was spent on shampoo, toilet paper, trash bags, and mascara, so I mark that amount under the toiletries section.

In each budget section, I write the store that I shopped at, how much I spent, and then I subtract that amount from my total budget for that category so that I know how much I have left to spend in that category for the month.

Here’s what my filled in budget spreadsheet looks like about halfway through the month:

When my husband shops or stops for gas, he knows to grab a receipt and give it to me. If he forgets or can’t get one, I’ll just ask him what he spent money on when I look at our account online.

It’s a really simple system that has worked well for us for years. It only takes about 5 minutes to maintain each week and we know exactly where we’re at with our spending all the time.

A few days before the next month, I’ll open up my budget spreadsheet and change any numbers that I need to, like if there are 5 weeks in the month instead of 4, I’ll up our grocery budget amount.

I print out my spreadsheet and keep it with my “binder of important things” in the kitchen where I’m most likely to remember to record my receipts.

Why A Simple Budget Spreadsheet Is Awesome:

- It’s FREE! You’ll spend money on almost all of the apps and software out there that help you track your spending. Pretty much every computer comes with software that you can use to make a spreadsheet. Why spend extra money when you’re trying to save money?

- It’s Easy! It took me about 30 minutes a few years ago to make this spreadsheet up. I spend about 5 minutes adjusting my numbers for each month, and it’s good to go.

New!

You can now download my free printable expense tracker! Customize it to fit your needs and track your spending:

[convertkit form=4899234]

Related Posts:

My Favorite Part of Our Finances: The Emergency Fund

The 5 Biggest Ways We Save Big Money

7 Benefits of a Smaller Home - The (mostly) Simple Life

Wednesday 23rd of November 2016

[…] The Simple Way We Track Our Spending on a Tight Budget […]

Sonia

Monday 8th of August 2016

Can you please post a budget sheet not filled in , just with the categories like before you put in your numbers as a download for all of us? It would be very helpful! I just started a blog and will be referring people to your site and articles. I am not published yet.They are fantastic!What template are you using for Wordpress? Your layout and colors on your site are stunning!

Christine

Monday 8th of August 2016

I'm working on making my budget sheet downloadable, so it's coming!

Haylie

Wednesday 3rd of August 2016

I love this! Such a simple way to organize everything. One question though - if you have $180 set aside for food, and then find at the end of the month that you only spent $165, what do you do with the rest? Do you roll it over so the next month you have $195? Do you put it into savings?

Christine

Wednesday 3rd of August 2016

I usually end up using our entire grocery budget. If I have some left over, I might stock up on some things on sale that week or roll it over to the next month. I budget pretty tight though, so it's not like I have a huge excess. If for some reason there was a large excess, I would most likely put it in savings.

Charisse

Thursday 21st of July 2016

Love it! I don't like hooking up to accounts either. I use moneytrackin.com and I love how easy it is!

Christine

Thursday 21st of July 2016

I haven't seen that one yet, I'll have to check it out! Thanks Charisse!

Kathryn @ Making Your Money Matter

Saturday 4th of June 2016

While I personally don't have an issue with having my information in a personal finance software, I still think your spreadsheet and method of tracking all your expenses in a simple way is awesome. I love that it is all on the one page and that you have a method for making sure all your bills get paid as well. I LOVE my spreadsheets!

Christine

Saturday 4th of June 2016

Thanks Kathryn! I love to keep things simple!