Today I’m sharing what our average monthly budget looks like and how we live on less than $1500 a month. Eeek! I’m a bit nervous.

I’m not sharing this because I think it’s possible for everyone to live on how much we do.

Obviously, some parts of the world are more expensive than others and there are tons of other factors, like family size, hobbies, and health concerns to take into account.

I’m sharing it in hopes that it might inspire you to find ways to cut certain parts of your spending and because seeing how we handle our money might give you ideas of how to handle yours.

NOTE: Our budget has changed since I originally wrote this post in 2016. Our budget looked like this for about 5 years. If you’re interested in our current budget, you can read about how we live on $2500 per month.

One of the very best things you can do to start getting a handle on your finances is track your spending! You can download and print my free spending tracker printable and take action today!

If you are searching for ways to cut back, this book was a huge inspiration for me when we first got married and were living on an even tighter budget: America’s Cheapest Family.

If you are struggling with debt, budgets, or paying your bills, I highly recommend reading The Total Money Makeover by Dave Ramsey. He lays out a step by step plan for getting in control of your finances and becoming debt free.

Some Basics About Our Budget:

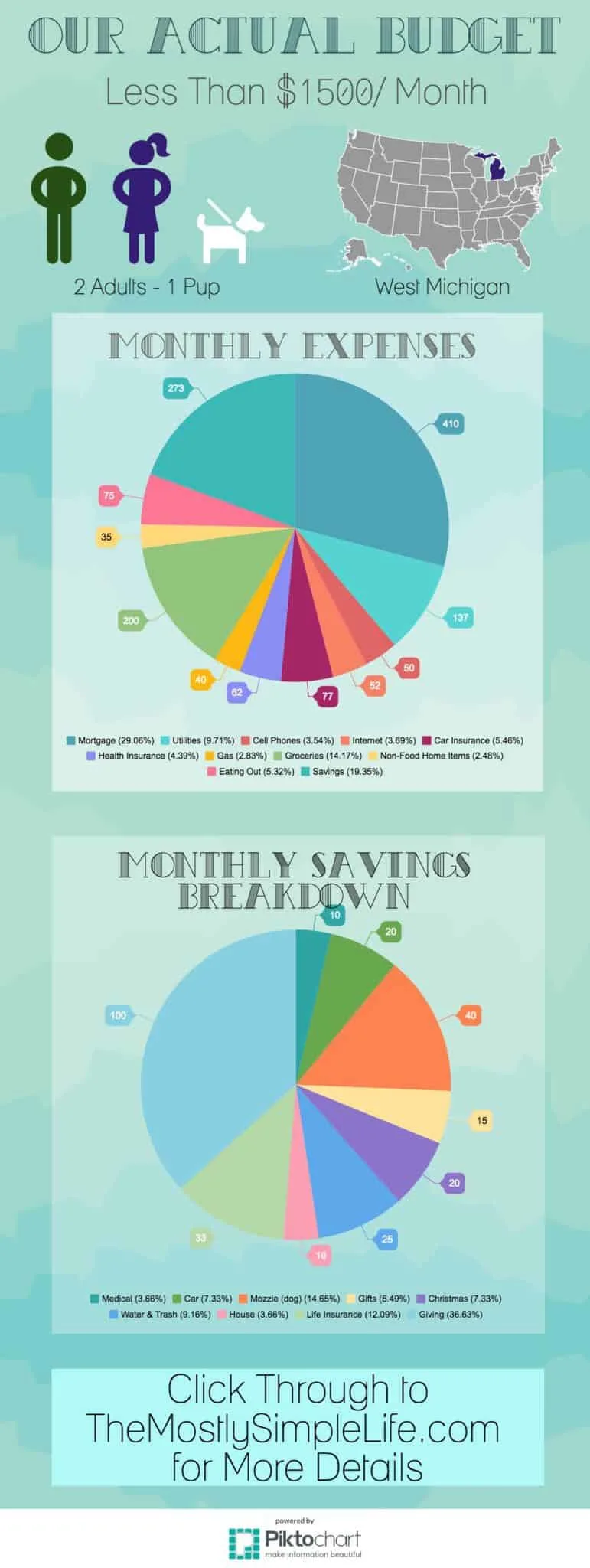

Our budget is for two adults and one spoiled pup.

We live in a very low cost of living area in West Michigan.

Our house payment is crazy-low (yes, that number includes taxes and insurance), for which I am grateful every single day. We purchased a foreclosure home when prices were low and we had help from a local nonprofit to make the house livable.

We could have easily spent more, but we had decided that it was really important to us to not overspend on housing. We wanted a payment that we were comfortable with. Check out my post about the #1 mistake you don’t want to make when buying a house.

We don’t have a car payment and we pay our credit card off completely every month, so no debt payment there either.

Our budget stays relatively the same month to month because we have separate, mini savings funds for irregular bills and expenses that we contribute a little into monthly.

If we make more than we need for our regular monthly budget (we usually do), we decide how to spend/save the extra money: retirement fund, beefing up our mini savings funds, spending on something we want…

So essentially, this is our “bare bones” budget. If we want to save or spend above this bare bones budget, we need to make extra money.

You Might Like These Posts Too:

Our Average Budget – How We Live On Less Than $1500 A Month

Mortgage: $410.00

We decided to purchase a foreclosure home when prices were low and we had help from a local nonprofit to make the house livable.

Electric: $91.00

On a budget plan to keep it the same every month.

Natural Gas: $46.00

On a budget plan to keep it the same every month.

Cell Phones: $50.00

We each have a super basic “non-smart” cell phone. No texting plan, no data plan. It saves us a TON of money.

Internet: $52.00

Car Insurance: $77.00

We share one car which also saves a ton.

Health Insurance: $62.00

High deductible insurance.

Gas: $40.00

Groceries: $180.00 or $45.00/week

If you look below, you will see that we also have a mini savings fund for groceries for our every-couple-months trip to the “big city” to stock up on meat and non-perishables at Sam’s Club and Aldi. So we probably average about $50-55/week on groceries.

Meal planning is one of the most important things we do to save money on groceries. You can get the weekly meal plan printable I use each week by entering your info below!

[convertkit form=830245]

I use Ibotta to get money back on our groceries. They even have rebates for fruits, veggies, and store brand items! You can get $10 added to your account when you redeem your first rebate. I’ve even created a tutorial for exactly how I save money on fruits, veggies, and non-name brand foods.

Toiletries: $35.00

Our grocery budget is for food only. This part of the budget is for everything else like makeup, toilet paper, cleaning supplies, trash bags…

Eating Out: $75.00

This is the first place we cut back if we need to, but we really like to get takeout and go out 🙂

Extras: $15.00

This is just a mini-buffer for if we need something little: like if one of us needs new socks or we can’t pass up on some after Easter candy deals.

Monthly Deposits to Sinking Funds:

To keep our budget relatively the same every month, we deposit money each month into multiple savings accounts so that we aren’t caught off guard by irregular bills or expenses. You can read more about how this works in these posts:

I highly recommend using Capital One 360 to create sinking funds.

They allow you to have up to 25 separate savings accounts. You can nickname your accounts to correspond with your chosen categories and have money automatically deposited to each account as regularly as you want.

I plan our budget monthly, so I have money automatically added to our accounts on the first of every month.

I have used Capital One 360 for years now and these savings accounts have helped our budget immensely. Plus, they give you a 1% interest rate which is way better than our regular bank.

Here’s what gets deposited into our sinking funds each month:

- Medical: $10.00

- Car: $20.00

- Mozzie (our dog): $40.00

- Gifts: $15.00

- Christmas: $20.00

- Water & Trash City Bill: $25.00

- House Repairs: $10.00

- Life Insurance: $33.00

- Giving: $100.00

- Grocery Trip to the City: $25

Grand Total: $1431.00

That’s our basic “bare bones” budget showing how we live on less than $1500 a month. Like I said earlier, we usually make extra money each month. If we do, we decide how we want to spend or save it.

I hope our budget might give you a little hope or inspiration if you’re trying to live on less.

Related Posts:

- Save on Birthdays: 50+ Cheap Birthday Ideas.

- Grocery On a Budget: Save with this Cheap Grocery List.

- View Our Personal Budgeting Page.

- 13 Ways to NOT Spend Money

- Frugal Habits We’ve Built into Every Day

Feature image background from Vecteezy.com

tripi

Tuesday 23rd of January 2024

we live modestly on 20000 for two alter-abled seniors who smoke a lot of weed. rent 700, internet/phones $100, power/water $70. Walk or take rare bus. Eat two meals a day at home or food cart take out. library books.instead of tv. healthcare? LOL. county medicare clinic. i'm no delicate snowflake. i recycle tp.

Jeff

Monday 10th of July 2023

My wife and I bought a cheap house with actual cash which seller was excited to see. I make around $1500 working from home and we have plenty to live on just with that. The secret was owning the home outright so we don't have to pay a $1500+ month rent or mortgage. Where we live, $1500 only gets you a 1 bedroom apartment and we have a 3 bedroom house.

Allow Me to Introduce Myself! - The (mostly) Simple Life

Monday 5th of December 2016

[…] Our Actual Budget: How We Live On $1500 Per Month […]

Why I'm Not Saving for Retirement - The (mostly) Simple Life

Wednesday 23rd of November 2016

[…] Our Actual Budget: How We Live On $1500 Per Month […]

Paying Cash for College as an Adult (it can be done!) - The (mostly) Simple Life

Wednesday 23rd of November 2016

[…] have lived on $1500 per month or less for our whole marriage. There have been times that we made more than that, which is when we […]